The crypto ecosystem is controlled by the financial institution, therefore investors are very careful trading, instead, they trade along the financial institutions' market surge. However, it is paramount for an investor willing to amass profit from every position in the market to be very concerned about trading with credible technical analysis.

Technical analysis is a technique traders use to look into the market before they take their position in the market, that is, the process an investor takes to check the market behavior before they pick up trade from the market.

Technical analysis is not done in a vacuum, investors who are involved in technical analysis naturally trade along the swings of the financial institutions, this means the financial institutions are the holders of the trade they control a large chunk of the market, and they often determine the market flow, therefore any investor who doesn't want to be a pig in the market must meticulously trade around the behavioral control of the market by the financial institution.

The article will give an expository view of the smart money concept technique used by the financial institution, how it will help your trading efficiency, and provide a better understanding.

Smart money concept

This is the trading technique the financial institution uses to trade in the crypto ecosystem. This concept is broad with strategies to trade. The smart money concept is greeted with different elements, these elements are the pillars of the trading structures which every investor must pay rapt attention to while trading.

The element

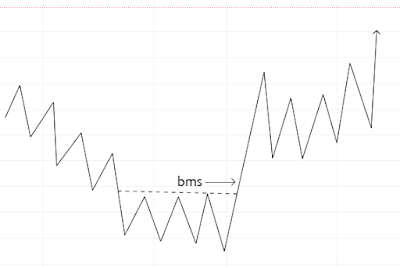

Break in market structure BMS

The break in market structure is an indication that reveals the behavior of the market telling traders the new structure the market is taking, this reveals the structure of the market when the market breaks an initial market structure moving from one direction to another direction. In other words, the market is taking an impulsive move toward one direction, the sudden switch toward another position.

Change of character COCH

This is just a suburb of BMS, we can classify it as a mini BMS, although it's classified as mini BSM this indicates a change of character within a trend without a break in the market structure. This is seen within a market when it's taking an impulsive move within a trend or swing.

Order blocks are the support and resistance regions of a chart. They are also the point where buying and selling happen in the market. Order block is crucial to every trader in the market because that is where they take a position from the market. At every point during technical analysis, investors study how the market swings within the order blocks.

Liquidity is a dangerous factor in the market that has swung many investors of their holdings. One of the ear points in the market by investors is the liquidity zone. This is the most meticulous point where investors pay more attention to technical analysis.

The financial institution often deploys the liquidity factor to pull many investors out of the market, therefore as an investor, pay more attention to the liquidity zone and study mitigated order blocks before you take a position, also study your confirmatory entering before you take a position.

Comments

Post a Comment