Price circle market structure gives you how prices move within a particular way in the market within 24 hours of trade over and over again, the same with the market stages, what traders fail to know about the market is the psychology of the market, the financial institution regularly greets you with financial psychology of the market, which implies that you can’t use your normal psychology to approach the market this might lead to fund liquidity.

The market is embedded with various junks which appear to be candles, they form different structures, move in different directions, and appear in different sizes. This on its looks like a noise to many traders, some fearing to approach because what appears in the market looks like a bunch of noise. Still, the truth is, that everything you see in the market can’t appeal to human psychology because the market naturally is meant to play on your psychology. Therefore, if you must understand what appears to be noise then you should understand the market psychology.

Market psychology is the different analysis approaches traders use to analyze the market. To know how the market is moving and understand every beat of swing then the psychology of the market should not be far-fetched.

Although there are different approaches to the market, some are based on speculation while others will give you 100 percent take profit. In today's analysis, we shall be doing justice to the 4 stages of the market, it is possible you believe that the price circle answers it all as far as market structure is concerned but every structure of the market is leveraged on the 4 stages of the market. You can't analyze using any strategies without first having the residual knowledge of the market stages.

Market stages.

The stage of the market depicts traders' behavior at every structure. That is, where every trader belongs in the market at every phase. The market is segmented into structures and every structure has its phases, these phases are the stages of the market. Irrespective of whichever way you want to approach the market, it is important to note that the market stage is the bedrock for every strategy you want to use.

The stages.

The accumulation stage.

The advanced stage.

The distribution stage.

The declining stage.

The accumulation stage.

These are the stages of the market that tell the behaviors of traders, at this stage, traders are investing their funds in the market, where funds are being gathered in the market for the market to take the next move. This points to the structure of the market, the structure appears in a consolidation form with a series of higher highs and higher lows. The market has a series of impulsive moves in a sideways direction, when you see this on the chart you know that this is the accumulation stage of the market.

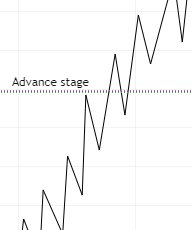

Advance stage.

The advance stage is bearish, at this point the accumulated fund will start to give the market another structure toward the bring swing. They depict that accumulated fund grows the market. In the structure of the market, when the advanced stage appears it pushes the market toward the bearish side. The market began to go up. The structure began to form a series of higher highs.

Distribution stage.

After so many series of higher highs that are presented in the advanced stage, the market will rest to form another level of consolidation, but at this level, it is termed distribution, the funds in the market accumulate to determine another structure it wants to form but at the point, the market has the high tendency of moving down. After the advanced stage, the distribution stage is formed.

Declining stage.

The declining stage is when the market starts going down, here in the market, the investors are withdrawing their money from the market. Then the market started declining. This is the area that scares the investors the most because everyone is FOMO out of the market. The structure of the market at the declining stage begins to form a series of lower highs and lower lows in a downward direction.

As a trader, you should pay very good attention to the market at the declining stage because it's always the liquidity stage of the market. Nevertheless, some traders always take advantage of the declining stage, and many of them always see it as an avenue to short the market, especially the ones that are into future trading.

Trading can never be done in a vacuum, no matter the strategy you want to deploy into trading, the stages of the market are the bedrock that will leverage your analysis. Every structure you see can be traced to the stages of the market and any structure you see can easily tell what is happening at that very moment in the market.

Comments

Post a Comment